Reinforce Your Legacy With Expert Trust Fund Foundation Solutions

In the world of heritage preparation, the importance of developing a strong structure can not be overstated. Expert trust fund foundation options provide a durable structure that can protect your possessions and guarantee your desires are lugged out precisely as meant. From decreasing tax obligations to picking a trustee who can properly handle your events, there are vital considerations that require attention. The complexities entailed in trust fund structures require a critical strategy that straightens with your long-term objectives and worths (trust foundations). As we look into the subtleties of trust fund structure remedies, we reveal the crucial elements that can strengthen your heritage and give a long-term influence for generations ahead.

Benefits of Trust Fund Structure Solutions

Trust fund structure options use a robust framework for protecting possessions and guaranteeing long-term financial security for people and companies alike. Among the main benefits of count on foundation remedies is property protection. By developing a trust, people can shield their assets from prospective risks such as lawsuits, lenders, or unexpected financial responsibilities. This protection makes certain that the assets held within the trust fund stay protected and can be handed down to future generations according to the individual's dreams.

Through trusts, individuals can outline how their assets ought to be handled and distributed upon their passing. Counts on also offer privacy benefits, as properties held within a trust fund are not subject to probate, which is a public and often lengthy legal process.

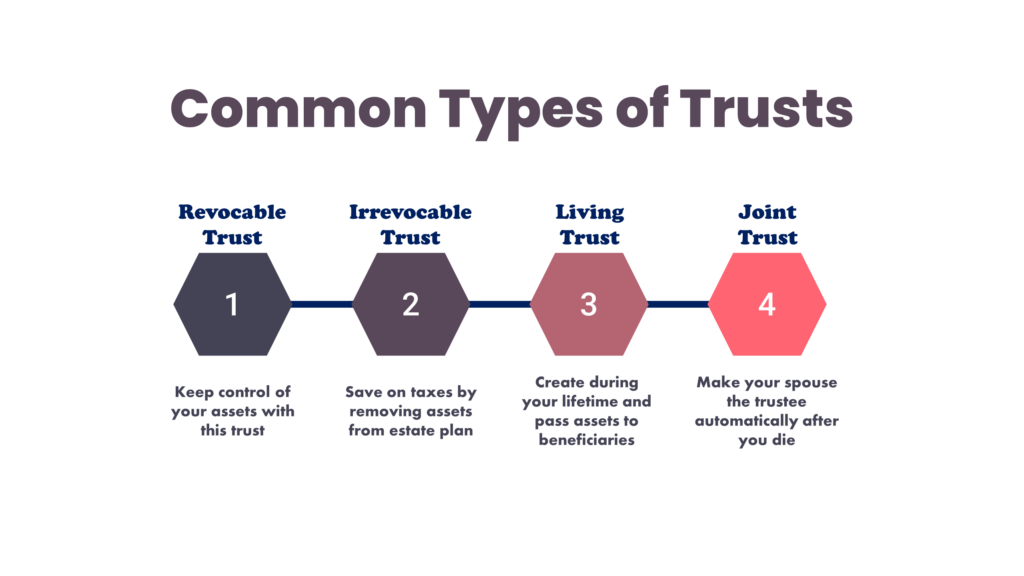

Sorts Of Trusts for Heritage Preparation

When taking into consideration heritage preparation, a crucial facet entails discovering different sorts of legal tools made to protect and distribute assets effectively. One usual kind of count on used in heritage preparation is a revocable living count on. This trust permits individuals to maintain control over their assets throughout their lifetime while ensuring a smooth change of these possessions to beneficiaries upon their passing, staying clear of the probate process and providing personal privacy to the family members.

Charitable depends on are additionally prominent for people looking to support a reason while preserving a stream of income for themselves or their beneficiaries. Unique demands counts on are necessary for people with impairments to ensure they obtain essential care and support without endangering federal government advantages.

Recognizing the different kinds of depends on readily available for heritage preparation is crucial in establishing a detailed approach that straightens with specific goals and priorities.

Selecting the Right Trustee

In the realm of tradition preparation, an essential aspect that demands careful consideration is the selection of an appropriate individual to fulfill the critical role of trustee. Picking the right trustee is a decision that can considerably impact the successful execution of a count on and the fulfillment of the grantor's wishes. more helpful hints When selecting a trustee, it is vital to prioritize qualities such as trustworthiness, financial acumen, honesty, and a dedication to acting in the most effective passions of the beneficiaries.

Ideally, the selected trustee must have a solid understanding of monetary issues, be qualified of making sound investment choices, and have the capacity to navigate complicated lawful and tax obligation requirements. By thoroughly taking into consideration these factors and choosing a trustee that straightens with the worths and objectives of the count on, you can aid make certain the long-term success and preservation of your tradition.

Tax Obligation Implications and Benefits

Considering the fiscal landscape bordering trust fund frameworks and estate planning, find here it is paramount to look into the complex world of tax obligation ramifications and advantages - trust foundations. When developing a depend on, recognizing the tax obligation effects is critical for optimizing the benefits and minimizing potential liabilities. Trusts offer various tax advantages depending on their structure and purpose, such as decreasing estate taxes, earnings taxes, and gift taxes

One significant benefit of particular trust fund frameworks is the capability to move assets to recipients with decreased tax obligation repercussions. For instance, irrevocable trusts can eliminate assets from the grantor's estate, possibly decreasing inheritance tax obligation. In addition, some depends on allow for income to be distributed to recipients, that might remain in lower tax obligation braces, leading to overall tax savings for the family.

Nonetheless, it is very important to note that tax legislations are intricate and conditional, highlighting the necessity of seeking advice from tax professionals and estate planning specialists to make sure conformity and make the most of the tax obligation benefits of trust fund foundations. Effectively navigating the tax obligation implications of trust funds can result in substantial savings and a much more reliable transfer of riches to future generations.

Actions to Establishing a Depend On

To develop a count on efficiently, meticulous interest to information and adherence to legal procedures are essential. The very first action in developing a count on is to plainly visit this site right here specify the purpose of the depend on and the properties that will be included. This includes recognizing the recipients who will gain from the trust fund and appointing a credible trustee to handle the properties. Next off, it is crucial to select the sort of depend on that ideal aligns with your goals, whether it be a revocable count on, irreversible trust fund, or living trust fund.

:max_bytes(150000):strip_icc()/trust-fund-4187592-1-58df0cb75cbc432090ea169f30193611.jpg)

Final Thought

To conclude, establishing a count on structure can offer countless benefits for heritage preparation, including property protection, control over circulation, and tax advantages. By picking the proper kind of trust and trustee, people can secure their assets and guarantee their desires are performed according to their needs. Comprehending the tax effects and taking the required actions to develop a count on can aid enhance your legacy for future generations.

Comments on “Select Trust: Secure Trust Foundations for Your Building And Construction Endeavors”